Business Studies Chapter 10 Notes NCERT Class 11th

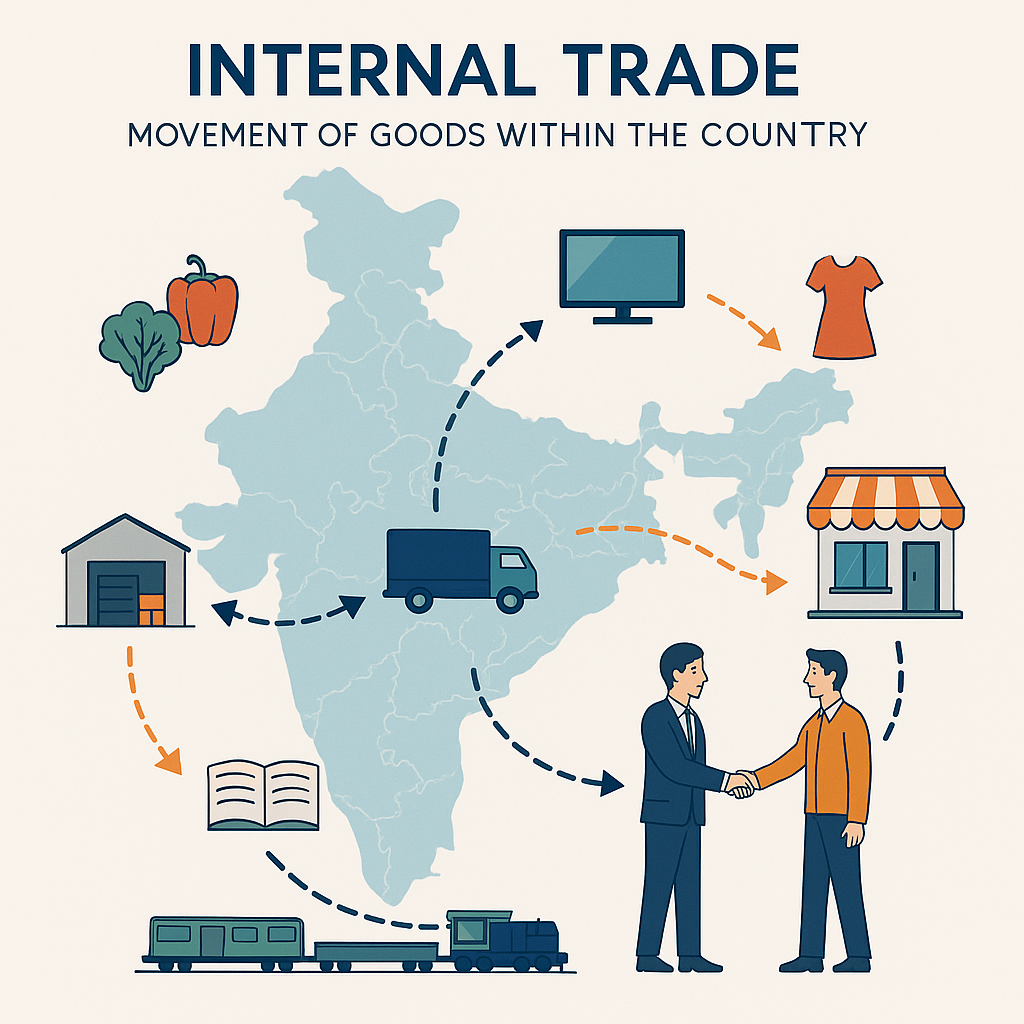

10.1 Introduction to Trade

- Definition: Trade refers to the buying and selling of goods and services with the objective of earning profit.

- Classification based on geographical location:

- Internal Trade: Trade that takes place within the boundaries of a nation.

- External Trade: Trade between two or more countries.

10.2 Internal Trade

- Definition: Buying and selling of goods and services within a nation’s boundaries.

- Key Characteristics:

- No custom duty or import duty is levied.

- Payment is generally in the legal tender of the country.

- Categories of Internal Trade:

- Wholesale Trade

- Retail Trade

- Objective: Aims at equitable distribution of goods within a nation speedily and at a reasonable cost.

10.3 Wholesale Trade

- Definition: Purchase and sale of goods and services in large quantities for the purpose of resale or intermediate use.

- Wholesalers: Traders dealing in wholesale trade.

- Role: Serve as an important link between manufacturers and retailers.

- Functions:

- Take title of goods and bear business risks.

- Purchase in bulk and sell in small lots.

- Undertake grading, packing, storage, transportation, and promotion.

- Collect market information and orders from retailers.

- Relieve retailers of maintaining large stock and extend credit facilities.

- Services of Wholesalers: Wholesalers provide time and place utility by making products available when and where needed.

10.3.1 Services to Manufacturers

- Facilitating large-scale production: Wholesalers pool small orders from retailers, enabling manufacturers to produce in bulk and achieve economies of scale.

- Bearing risk: They bear risks like price falls, theft, spoilage, and fire, relieving manufacturers.

- Financial assistance: Generally make cash payments to manufacturers for purchases and sometimes provide advances for bulk orders.

- Expert advice: Provide manufacturers with information on customer tastes, market conditions, and competitive activities.

- Help in marketing function: Manage distribution to numerous retailers, allowing manufacturers to focus on production.

- Facilitate production continuity: Purchase and store goods as they are produced, ensuring continuous production throughout the year.

- Storage: Take delivery of goods and store them, reducing the storage burden on manufacturers.

10.3.2 Services to Retailers

- Availability of goods: Make products from various manufacturers readily available to retailers, reducing the need for large inventory.

- Marketing support: Undertake advertising and sales promotional activities, helping retailers increase demand.

- Grant of credit: Extend credit facilities to regular customers, helping retailers manage working capital.

- Specialised knowledge: Share market knowledge, new product information, and advice on store decor and shelf space with retailers.

- Risk sharing: By selling in smaller quantities, wholesalers help retailers avoid risks associated with large stock, such as storage, obsolescence, and price fluctuations.

10.4 Retail Trade

- Definition: A business enterprise engaged in the direct sale of goods and services to ultimate consumers.

- Retailer: Buys goods in large quantities from wholesalers and sells them in small quantities to consumers.

- Final Stage of Distribution: Represents the point where goods are transferred from manufacturers or wholesalers to final consumers.

- Functions of a Retailer: Purchases varied products, arranges storage, sells in small quantities, bears risks, grades products, collects market information, extends credit, and promotes sales.

10.4.1 Services to Manufacturers and Wholesalers

- Help in distribution of goods: Make products available to scattered final consumers, providing place utility.

- Personal selling: Relieve producers of personal selling efforts, aiding in sales actualisation.

- Enabling large-scale operations: Free manufacturers and wholesalers from individual sales, allowing them to focus on larger scale operations.

- Collecting market information: Provide direct market insights on customer tastes, preferences, and attitudes, useful for marketing decisions.

- Help in promotion: Participate in promotional activities (e.g., advertising, incentives) to boost product sales.

10.4.2 Services to Consumers

- Regular availability of products: Ensure continuous availability of various products from different manufacturers.

- New products information: Provide information on new products, features, and arrival through displays and personal selling.

- Convenience in buying: Sell in small quantities, are usually located near residential areas, and operate for long hours, offering convenience.

- Wide selection: Keep a variety of products from different manufacturers, enabling consumers to make diverse choices.

- After-sales services: Provide services like home delivery, spare parts, and customer support, influencing repeat purchases.

- Provide credit facilities: Offer credit to regular buyers, enhancing their consumption and standard of living.

Terms of Trade

- Cash on Delivery (COD): Payment for goods or services made at the time of delivery.

- Free on Board (FOB) or Free on Rail (FOR): Seller bears all expenses up to the point of delivery to a carrier.

- Cost, Insurance and Freight (CIF): Price includes cost of goods, insurance, and freight charges up to the destination port.

- Errors and Omissions Excepted (E&OE): Used in trade documents to account for mistakes and forgotten items.

10.5 Types of Retailing Trade

- Classification Basis: Can be classified by size, ownership, merchandise handled, or fixed place of business.

- Two main categories based on fixed place of business:

- Itinerant Retailers

- Fixed Shop Retailers

10.5.1 Itinerant Retailers

- Definition: Traders without a fixed place of business, who move from place to place.

- Characteristics:

- Small traders with limited resources.

- Deal in daily-use consumer products (e.g., toiletries, fruits, vegetables).

- Focus on providing doorstep service to customers.

- Keep limited inventory at home or other places.

- Common Types in India:

- Peddlers and Hawkers: Carry products on bicycles, handcarts, or on their heads, selling non-standardised, low-value goods like toys, vegetables, fabrics.

- Market Traders: Open shops at different places on fixed days, dealing in specific merchandise (e.g., fabrics, toys) or general goods, catering to lower-income groups.

- Street Traders (Pavement Vendors): Found at high-traffic areas (e.g., railway stations), selling common consumer items like stationery, eatables, ready-made garments.

- Cheap Jacks: Petty retailers with temporary independent shops who change localities based on potential, dealing in consumer items and services.

10.5.2 Fixed Shop Retailers

- Definition: Retail shops with permanent establishments.

- Characteristics:

- Generally have greater resources and operate on a larger scale than itinerant traders.

- Deal in consumer durables and non-durables.

- Offer greater credibility and services like home delivery, guarantees, repairs, and credit facilities.

- Types based on size of operations:

- Fixed Shop Small Retailers

- Fixed Shop Large Retailers

Fixed Shop Small Retailers

- General Stores: Common in local markets and residential areas, stocking a variety of daily-need products. Open long hours and often provide credit to regular customers.

- Speciality Shops: Becoming popular in urban areas, these stores specialize in a specific line of products (e.g., children’s garments, men’s wear, electronics). Located in central places, they offer wide choice within their specialization.

- Street Stall Holders: Similar to street traders but with fixed, limited space, dealing in cheap variety goods like hosiery, toys, cigarettes.

- Second-hand Goods Shop: Deal in used goods (books, clothes, automobiles, furniture) sold at lower prices, catering to persons with modest means. Some may also stock antique items.

Fixed Shop Large Stores

- 1. Departmental Stores:

- Definition: Large establishments offering a wide variety of products classified into well-defined departments, aiming to satisfy nearly every customer’s need under one roof.

- Features:

- May provide extensive facilities like restaurants, travel bureaus, rest rooms.

- Generally located in central city areas.

- Often structured as joint-stock companies managed by a board of directors.

- Combine retailing and warehousing functions, purchasing directly from manufacturers.

- Centralized purchasing with decentralized sales.

- Advantages:

- Attract large numbers of customers due to central location.

- Convenience in buying a wide variety of goods under one roof.

- Offer attractive services like home delivery, telephone orders, credit facilities.

- Benefit from economies of large-scale operations, especially in purchasing.

- Can spend considerably on advertising and promotions, boosting sales.

- Limitations:

- Lack of personal attention due to large-scale operations.

- High operating costs leading to higher prices, less attractive to lower-income groups.

- High possibility of losses due to high costs and large inventory (e.g., fashion changes requiring clearance sales).

- Inconvenient location for quick purchases as they are centrally located.

- 2. Chain Stores or Multiple Shops:

- Definition: Networks of retail shops owned and operated by manufacturers or intermediaries, with similar appearance and merchandising strategies.

- Features:

- Located in populous localities to serve customers near their residence or workplace.

- Centralized manufacturing/procurement at a head office, leading to cost savings.

- Each shop managed by a Branch Manager who reports daily to the head office.

- All branches controlled by the head office, which formulates policies.

- Fixed prices and cash sales; cash deposited daily into local bank accounts for the head office.

- Head office appoints inspectors for supervision of quality and adherence to policies.

- Advantages:

- Economies of scale due to central procurement.

- Elimination of unnecessary middlemen by selling directly to consumers.

- No bad debts as sales are cash-based.

- Flexibility in transferring goods between shops reduces dead stock.

- Diffusion of risk: losses in one shop can be offset by profits in others.

- Lower overall operating costs due to centralized functions and increased sales.

- Flexibility to close or shift unprofitable shops without significantly affecting overall profitability.

- Limitations:

- Limited selection of goods, especially if owned by manufacturers (e.g., selling only their own products).

- Lack of initiative among personnel due to strict adherence to head office instructions.

- Mail Order Houses (Mail Order Business):

- Definition: Retail outlets that conduct business through mail, without direct personal contact between buyers and sellers.

- Process: Orders received via post, advertisements, or catalogues. Goods sent by post, rail, or vending machines upon full payment.

- Suitability of Products: Best for goods that are graded, standardized, easily transportable, have ready demand, are available in large quantities, and can be described through pictures. Not suitable for perishable or bulky goods.

- Advantages:

- Limited capital requirement as no heavy expenditure on buildings.

- Elimination of middlemen, leading to savings for both buyers and sellers.

- Absence of bad debts due to cash-only sales.

- Wide reach to all places with postal services.

- Convenience for customers as goods are delivered at their doorstep.

- Limitations:

- Lack of personal contact, leading to potential misunderstandings and mistrust.

- High promotion costs due to heavy reliance on advertisements.

- No inspection of goods before purchase by buyers.

- Delayed delivery as goods are sent by post.

- Not suitable for all types of products.

- Requires a widespread literate population for success.

- Consumer Cooperative Stores:

- Definition: Stores owned, managed, and controlled by consumers, aiming to reduce the number of middlemen.

- Objective: To provide consumer goods of good quality at reasonable prices.

- Management: Managed by an elected managing committee.

- Funding: Capital is raised through shares from members.

- Registration: Must be registered under the Cooperative Societies Act.

- Advantages:

- Ease of formation: Any ten people can form a voluntary association.

- Limited liability of members.

- Democratic management: Each member has one vote.

- Lower prices due to elimination of middlemen.

- Cash sales reduce working capital requirements.

- Convenient locations.

- Limitations:

- Lack of initiative among honorary managers.

- Shortage of funds due to limited membership.

- Lack of patronage from members.

- Lack of business training among managers.

- Super Markets:

- Definition: Large retailing units selling a wide variety of consumer goods based on low prices, wide variety, self-service, and strong merchandising appeal.

- Products: Generally food products and other low-priced, branded, and widely used consumer goods (e.g., groceries, utensils, electronic appliances).

- Location: Usually in main shopping centers.

- Features: Goods kept on racks with clear price and quality tags.

- Advantages:

- Central location attracts many customers.

- Economies of scale due to large-scale operations.

- Wide variety of products under one roof.

- No bad debts due to cash sales.

- Benefits of impulse buying due to self-service and product display.

- Limitations:

- No credit facilities, restricting purchasing power.

- No personal attention to customers due to self-service.

- Risk of mishandling goods by customers.

- High overhead expenses, which can negate low-price appeal.

- Huge capital requirement and need for high turnover, limiting viability in small towns.

- Vending Machines:

- Definition: Coin-operated machines useful for selling various products like hot beverages, tickets, milk, soft drinks, chocolates, and newspapers.

- Advantages: Provide convenience and are suitable for pre-packed low-priced products.

- Limitations: High initial installation and maintenance costs; not suitable for all products.

10.6 Role of Chambers of Commerce and Industry Associations in Promotion of Internal Trade

- Purpose: Associations like ASSOCHAM, CII, and FICCI are formed to promote and protect common business interests.

- Catalytic Role: Play a crucial role in strengthening internal trade.

- Interactions with Government: Interact at various levels to:

- Reduce hindrances to trade.

- Increase interstate movement of goods.

- Introduce transparency.

- Remove multiple layers of inspection and bureaucratic hurdles.

- Erect sound infrastructure.

- Simplify and harmonise tax structures.

- Intervention Areas:

- Interstate movement of goods: Facilitate vehicle registration, surface transport policies, and highway construction.

- Octroi and other local levies: Work to ensure these taxes do not hinder smooth transportation and local trade.

- Marketing of agro products: Associations of agriculturists help streamline local subsidies and marketing policies.

- Weights and Measures and prevention of duplication brands: Interact with the government to formulate and enforce laws protecting consumers and traders.

- Excise duty: Interact to streamline excise duties, which impact pricing.

- Promoting sound infrastructure: Discuss investments in infrastructure like roads, ports, electricity, and railways with government agencies.

- Labour legislation: Constantly interact with the government on issues related to labour laws and retrenchment.

Goods and Services Tax (GST)

- Key Features:

- Revolutionizing tax reform in India.

- Destination-based single tax on supply of goods and services.

- Replaced multiple indirect taxes levied by Central and State governments.

- Aims to unify the market.

- Expected to improve ease of doing business, reduce tax burden, improve administration, mitigate evasion, and boost revenues.

- Comprises Central GST (CGST) and State GST (SGST).

- Charged at each stage of value addition with input tax credit mechanism to avoid cascading effect (tax on tax).

- Makes luxury goods costlier and mass consumption items cheaper.

- Has a mechanism of matching invoices to check tax frauds and evasion.

- Anti-profiteering measures ensure benefits from cost reduction are passed to consumers.

- Benefits and Empowerment for Citizens:

- Reduction in overall tax burden.

- No hidden taxes.

- Development of a harmonised national market.

- Higher disposable income for education and essential needs.

- Wider choice for customers.

- Increased economic activity and employment opportunities.

- Key Features of GST:

- Applies to the whole country.

- Applicable on ‘supply’ of goods or services.

- Based on destination-based consumption tax principle.

- Import of goods and services subject to IGST and customs duties.

- CGST, SGST, and IGST rates mutually agreed upon by Centre and States.

- Four tax slabs: 5%, 12%, 18%, and 28%.

- Exports and supplies to SEZ are zero-rated.

- Various modes of tax payment available (Internet banking, debit/credit card, NEFT/RTGS).

- GST Council:

- Chairperson: Finance Minister.

- Vice Chairperson: Chosen from State Government Ministers.

- Members: MoS (Finance) and all Ministers of Finance/Taxation of each State.

- Quorum: 50% of total members.

- Weightage: States have two-thirds, Centre has one-third.

- Decision: Taken by 75% majority.

- Role: Makes recommendations on all aspects of GST, including rules and rates.